Should we?

“An expert is not someone who gives you the answer. It is someone who asks you the right question.”

It was inevitable not Intentional.

Local elected officials began trying to get companies to act against their business interest in order to meet a public need. These subsidies can only be given to a company if it would not have made the investment “but for” our public investment.

A data project undertaken by OpportunityInsights.org, gave an in-depth analysis of social indicators for policymakers trying to create opportunity for children born into poverty.

During the time period of the data, in the era of financialization, Charlotte exploded in size becoming the second largest banking city in the country. (In economic terms, the CEOs of two of the largest banks in the country, now Bank of America and Wells Fargo, shifted “M” in the region. :) ) The rich got richer and the American Dream died. Charlotte is simply the most extreme example since it had the highest natural growth.

For decades policymakers have known lack of income is the reason of demand for public services. A high unemployment rate in an area signals a need for investment. The problem isn’t the demand for investment or seeking investment. That investment is not profitable or it would exist already. To treat individuals equally, all people should benefit from the incentives that reflect a subsidy of overhead. The (I/O) models used to quantify benefits are clear. It’s profit. It’s not the problem.

In addition to illustrating social indicators of poverty, the data proves the “but for” test and using tax incentives in the private sector in Right-to-Work states failed. Companies seek to lower overhead.They avoid unions. This is not malice. Subsidizing it does not work. Using tax dollars to pay the overhead of companies with money does not benefit the rest of us.

If we invest as a nonprofit where it’s needed most and considered unprofitable, we can close the gap that’s our legacy of redlining. It’s a catalyst. This long-term investment is the solution to our city’s greatest problems if we do this ourselves. During the era of financialization, foundations amassed wealth. Care-givers and nonprofits began competing for funding. Collaboration became more challenging.

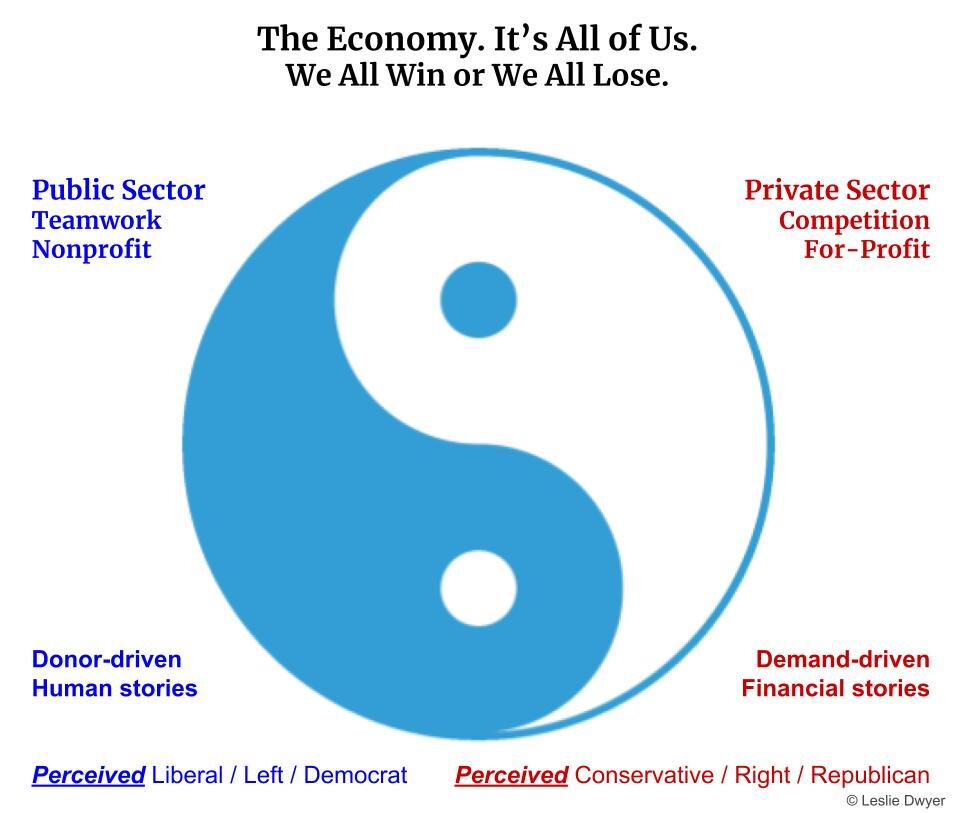

We all win or we all lose.

Should we?

Of the 50 largest cities in the United States, Charlotte is the hardest to escape poverty. Does giving tax dollars to private companies help Charlotte’s citizens? Does it work?

Do we agree?

Economic development incentives began as an attempt to get companies to invest in areas of most need. Is there a reason people on the Left and the Right are both skeptical? Are people on the Left and the Right both right at the same time?

Need or Want?

The analysis says it “brings investment” and therefore it “works.” It began in an attempt to target investment in areas of most need. It’s sold as a way to support upward mobility. When is the goal to bring investment and tax revenue? Is this “Want” or “Need”?

Who pays?

The analysis used to justify giving economic development uses regional data and ignores winners and losers in the region. Charlotte taxes are higher because Charlotte taxpayers pay for infrastructure, transportation, public safety and housing. Do those who benefit pay? Do those who pay benefit?

Charlotte has a Poverty problem.

On any given night over 2,000 people in Charlotte will be homeless.

One-third of Charlotte’s homeless include families with dependent children.

Veterans are 50% more likely than the rest of us to become homeless.

Of the 50 largest cities in the U.S., Charlotte is the hardest for someone born into poverty to escape it.

The Middle

Left and right use financial terms. Trickle-down in the private sector is profit that occurs when people compete and find a willing buyer and seller. It did not work as public policy. Creating profit for a few at taxpayer expense leads to income disparity and favors those who have wealth. In the nonprofit sector, it deters collaboration.

Charlotte’s Task Force (LeadingOnOpportunity.org) makes the case for social and political capital. It was created without the other terms in an economy. Most of all it was created without an understanding of the model used to rationalize economic development tax incentives in the private sector.

To understand the Middle in our country why we aren’t being represented, we mush understand the distinction between the natural trickle-down that occurs as we pursue the American Dream fairly and the political “free lunch” trickle-down which is killing the American Dream. A Rosetta Stone, the translation between the left and right, the public sector and private sector of our economy can be found here.

If we begin BuyingItBack, we’ll make the most economically fragile in Charlotte less sensitive to a recession. Our neighbors in most need will require fewer services in a recession. We all win.

Together we can correct our City’s legacy from redlining. Charlotte’s the city that banking build.

Should we?

In the long run, we all don’t win when we give economic development incentives to private companies. Economic development is effective and efficient when partnered with nonprofit investment. Now? We don’t all win.

With nonprofit investment

We All Win.

The American Dream.

Good news: we agree.

Better news: it’s easy to fix.

Best news: we can buy it back.